Stock option profit calculator

Many online stock brokers now offer commission free trades the stock calculator gives you the option. Can be a great option.

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

Stock profit calculator to calculate the total profit or loss on any stock that you buy and sell.

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-02-7a6cec73fd1b4bbd877e5c61d8186b04.jpg)

. Projected Profit in the Stock Options Calculator is the return on your Sold Option Contract at the Target Stock Price you entered. Your 1 Best Option for Custom Assignment Service and Extras. Calculate Profit Loss.

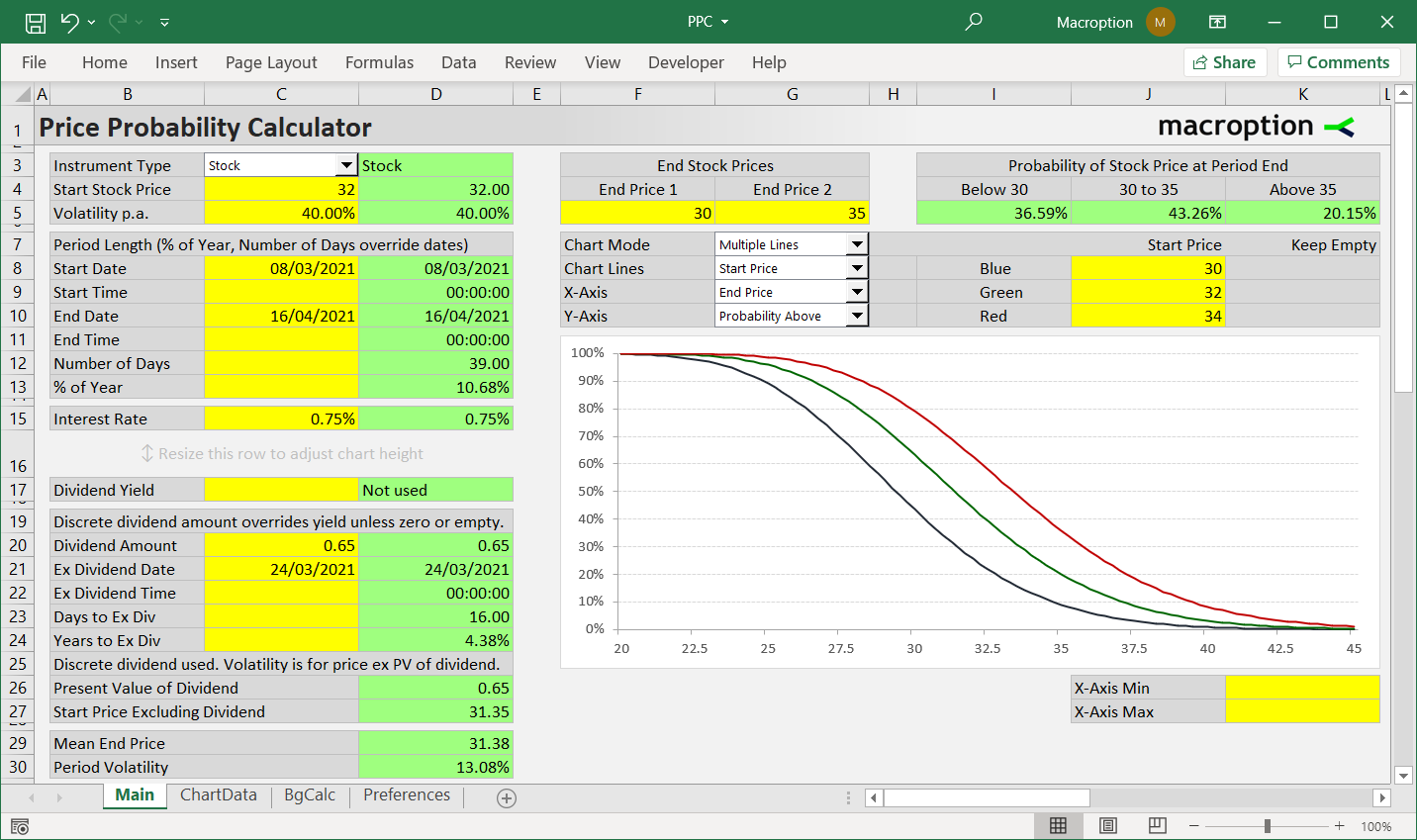

You can use our calculator above which uses the Black Scholes formula to estimate the value of a long call purchase before or at expiry. The fair market value of the stock on the day you donate it is 1000 but you paid only 800 your basis. You can get started for free to get the latest data.

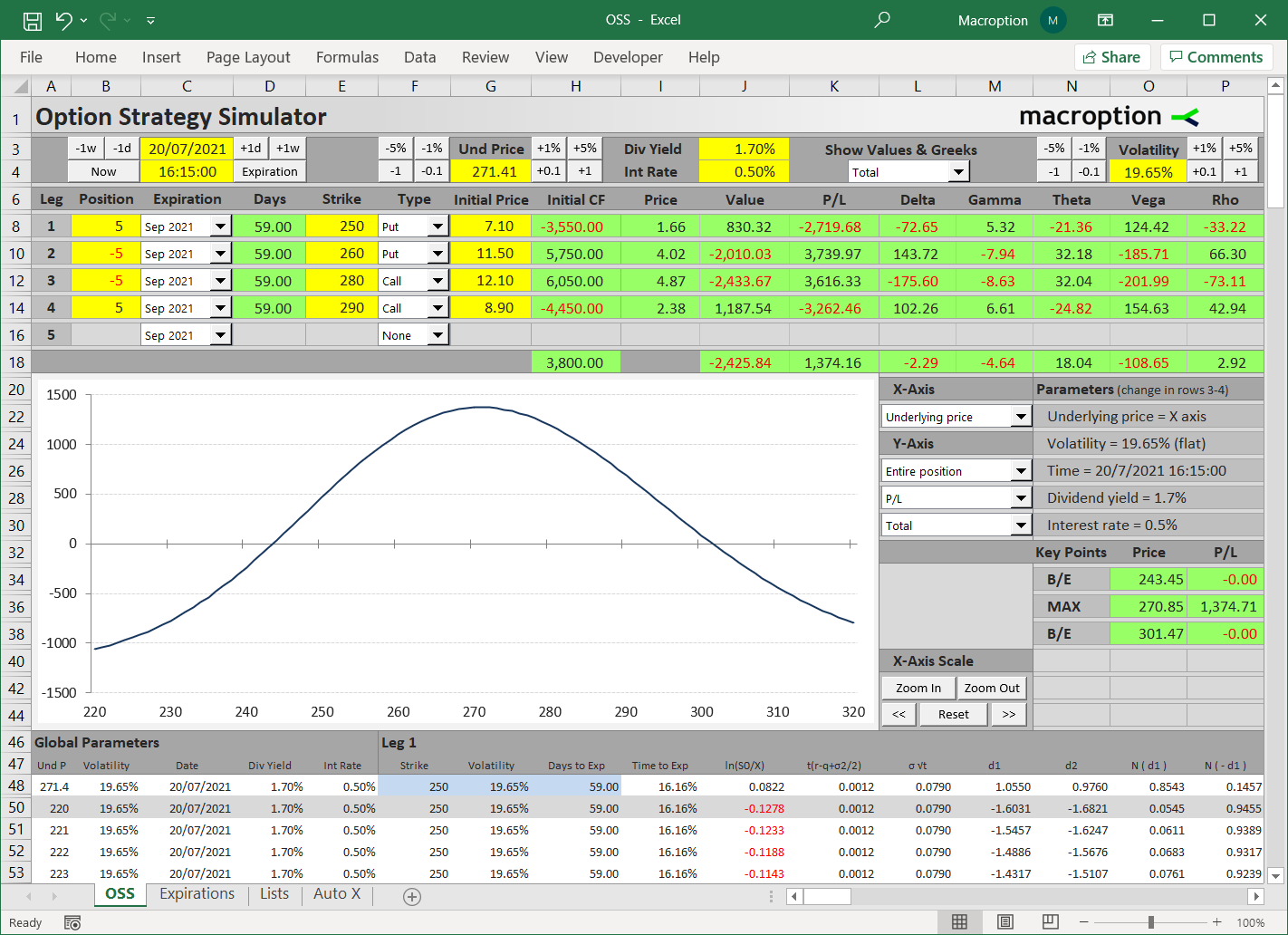

Creating Stock-Based Option Strategies like a covered call with the Advanced Option Profit Calculator Excel. An equity stock option. You profit when the shares youve bought become worth more than the strike.

When you exercise Incentive Stock Options you buy the stock at a pre-established price which could be well below actual market value. The simple stock calculator has options for buying price and selling price as well as trading commissions for each trade. As Close to 100 As You Will Ever Be.

As per Investopedia Trading options without an understanding of the Greeks the essential risk measures and profitloss guideposts in options strategies is synonymous to flying a plane without the ability to read instrumentsOption Greeks denoted by certain Greek. You donate stock you held for 5 months to your church. In our case we are going to define it as 26.

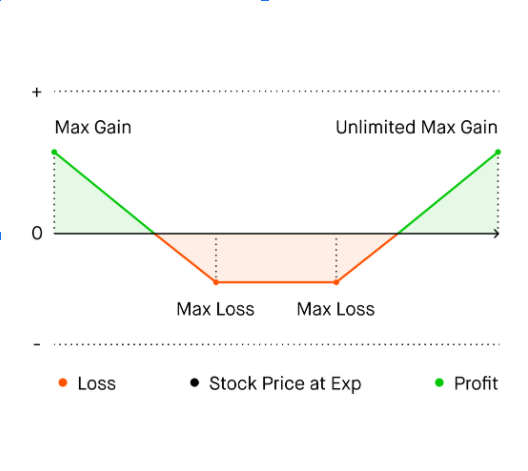

The maximum risk is at the strike price and profit increases either side as the price gets further from the chosen strike. Find the best spreads and short options Our Option Finder tool now supports selecting long or short options and debit or credit spreadsTry it out. ByteDances stock option programme called Restricted Stock Unit RSU will be offered at 155 per share this year and employees who were given shares at a higher price will be entitled to one.

It can help you in many more ways like. We will keep things where they are for now and explain the profit table which is the heart of OptionStrat. Take the hard work out of finding the right option with our Option Finder.

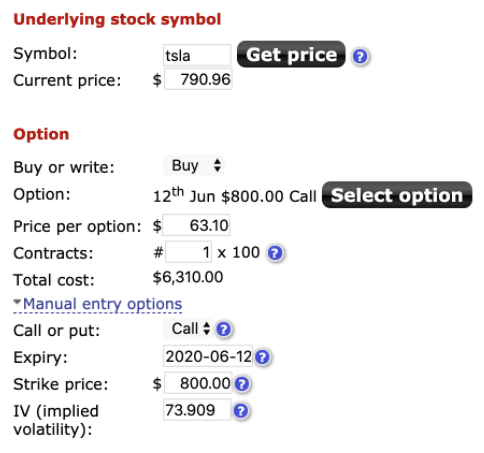

To create Stock-Based option strategies with the Advanced Option Trading Calculator we will need to define the stock price at which we bought the option. Analyze your options strategies. Option Price Paid per Contract - How much did you pay for the options for each contract.

Because the 200 of appreciation would be short-term capital gain if you sold the stock your deduction is limited to 800 fair market value minus the appreciation. Premium - The current market price of a companys shares and the amount you pay for the rights to a stock option. The advantage of an ISO is you do not have to report income when you receive a stock option grant or when you exercise that option.

Data is delayed from August 19 2022. In this interview compensation expert Richard Friedman Ayco Company discusses trends in vesting schedules post-termination exercise rules and other plan features. Support for Canadian MX options Read more.

A stock fund is an excellent choice for an investor who wants to be more aggressive by using stocks but. Stock Symbol - The stock symbol that you purchased your options contract with. The Profit Calculator will calculate the profit in money converted in account base currency previously selected and also the profit in the total amount of pips gained.

Options Type - Select call to use it as a call option calculator or put to use it as a put option calculator. Enter the price you expect the stock to move to by a particular date and the Option Finder will suggest the best call or put option to maximise profit at the expected price-point. While no one can perfectly predict the stock exchange an option profit calculator can help estimate your potential profit loss on an option contract.

Of Contracts - How many options contract did. In this case that is the 30 strike GME call for February 5th 2021. It is a strategy suited to a volatile market.

This is an optional field. This stock option calculator computes can compute up to eight contracts and one stock position which allows you to pretty much chart most of the stock options strategies. Finding the 1010 Perfect Cheap Paper Writing Services.

Purchasing a call with a lower strike price than the written call provides a bullish strategy Purchasing a call with a higher strike price. Cash Secured Put calculator addedCSP Calculator. You can compare the prices of your options by using the Black-Scholes formula.

Retirement plan income calculator. IV is now based on the stocks. Call Spread Calculator shows projected profit and loss over time.

A call spread or vertical spread is generally used is a moderately volatile market and can be configured to be either bullish or bearish depending on the strike prices chosen. An option profit calculator excel. Find Best Option Trading Strategy Builder Calculator in India.

Underneath the main pricing outputs is a section for calculating the implied volatility for the same call and put option. Then the investor could turn around and sell it for 50 making a profit of 10 less the cost of the option referred to as the premium. Profit stock price - strike price - option cost time value 100 number of contracts extrinsic premium is any cost above the intrinsic value.

Poor Mans Covered Call calculator addedPMCC Calculator. This does not account for the Time premium of the options contract strictly the Target Strike Price compared to the Current Price. Using the profit calculator table and chart.

Here you enter the market prices for the options either last paid or bidask into the white Market Price cell and the spreadsheet will calculate the volatility that the model would have used to generate a theoretical price that is in-line with the. 9 Promises from a Badass Essay Writing Service. What You Can Expect - 943 Get a sense of what you should and should not expect in the terms of your stock option grant.

The stock profitloss calculator created by iCalculator will assist you in determining the actual value of the returns on your stock investments. A straddle involves buying a call and put of the same strike price. Straddle Calculator shows projected profit and loss over time.

So for our example opening a long AUDUSD trade of 010 lots at 075345 and close it at 075855 will yield a profit of AUD 6766 profit in money with a. The calculator eases the complexity of the calculation by providing you with the option of factoring in the values of commission in. People who practice Options trading know very well how important Option Greeks are.

Professional Case Study Writing Help. And depending on. The interview is a companion to Mr.

You report the taxable income only when you sell the stock. Its a well-regarded formula that calculates theoretical values of an investment based on current financial metrics such as stock prices interest rates expiration time and moreThe Black-Scholes formula helps investors and lenders to determine the best. Click on the chart to center.

The Black-Scholes Option Pricing Formula. OptionStrat defaults to a call near the current price of the stock and to a strike about three weeks out.

/BinomialOptionPricingModel1_2-d49c047e5bd346d99c54e8bd3378bcdd.png)

Binomial Option Pricing Model Definition

Macroption Option Calculators And Tutorials

Employee Stock Options Financial Edge

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

The P L Chart Robinhood

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-02-7a6cec73fd1b4bbd877e5c61d8186b04.jpg)

Options Basics How To Pick The Right Strike Price

:max_bytes(150000):strip_icc()/dotdash_Final_Which_Vertical_Option_Spread_Should_You_Use_Sep_2020-03-34c346d142194e909757661f6cdcd95a.jpg)

Basic Vertical Option Spreads Which To Use

Macroption Option Calculators And Tutorials

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

/dotdash_Final_Weighted_Average_of_Outstanding_Shares_Oct_2020-01-4f04f4b373de45dea110be8462c0bf58.jpg)

Weighted Average Of Outstanding Shares Definition

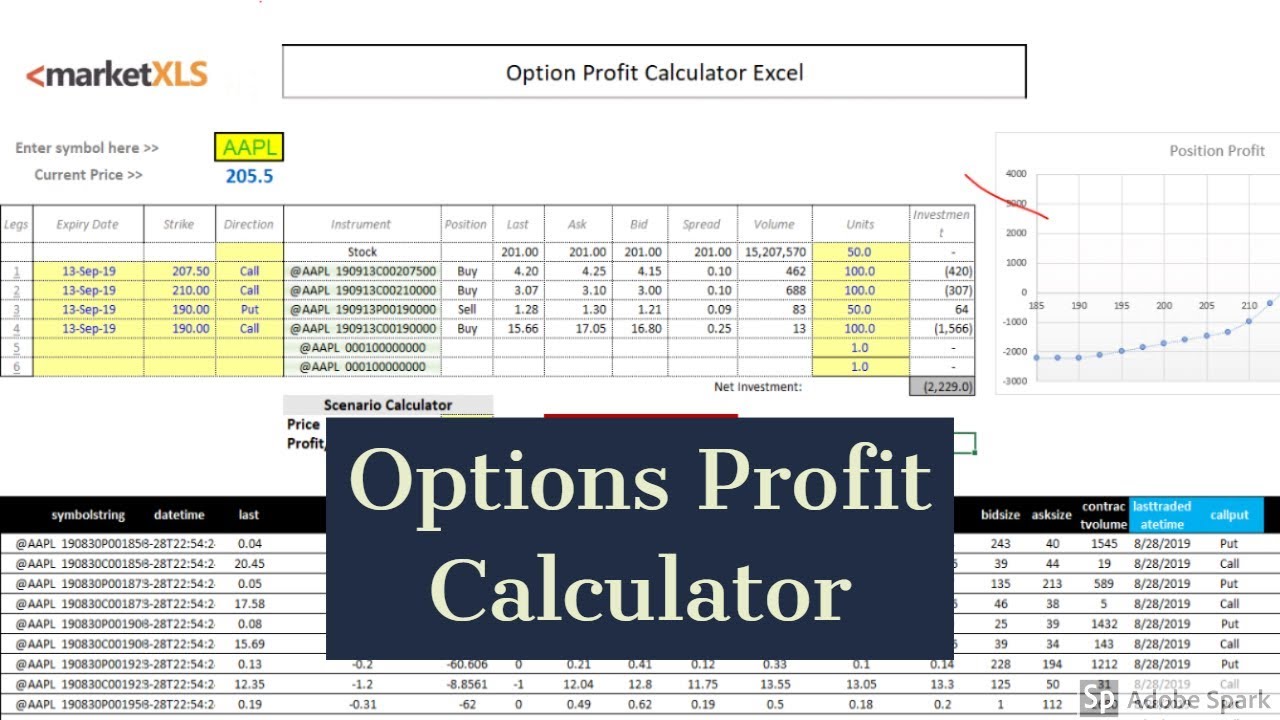

Options Profit Calculator Marketxls Options Download Option Data Templates Youtube

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Options Profit Calculator Updating An Estimate For An Existing Calculation On Options Profit Calculator

:max_bytes(150000):strip_icc()/BinomialOptionPricingModel1_2-d49c047e5bd346d99c54e8bd3378bcdd.png)

Binomial Option Pricing Model Definition

Options Strategy Payoff Calculator Excel Sheet Option Strategies Payoff Strategies

/BinomialOptionPricingModel1_2-d49c047e5bd346d99c54e8bd3378bcdd.png)

Binomial Option Pricing Model Definition